10 Undervalued Benefits Of Outsourcing Your Bookkeeping

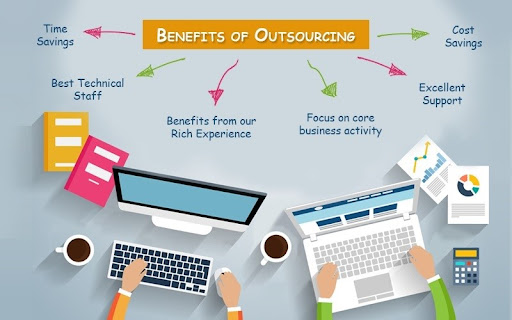

Outsourcing bookkeeping services has become a strategic decision for many businesses looking to streamline operations, enhance efficiency, and focus on core competencies. While the advantages of outsourcing bookkeeping are well-documented, there are several lesser-known benefits that businesses often overlook.

Outsourcing your bookkeeping provides access to a team of skilled professionals with expertise in accounting principles, tax regulations, and financial reporting standards. By following the benefits of outsourcing bookkeeping services, you can optimize your financial operations, mitigate risks, and unlock new opportunities for growth and prosperity in today’s dynamic business environment. In this guide, we’ll explore 10 undervalued benefits of outsourcing your bookkeeping and how they can positively impact your business.

1. Access to Expertise

Outsourcing services provides access to a team of skilled professionals with expertise in accounting principles, tax regulations, and financial reporting standards. These professionals bring years of experience and specialized knowledge to the table. Ensuring accurate bookkeeping, compliance with regulations, and timely financial reporting for your business.

2. Cost Savings

Outsourcing your bookkeeping can result in significant cost savings compared to hiring in-house staff or managing tasks internally. By outsourcing, you eliminate the need for salaries, benefits, training, and overhead costs associated with maintaining an in-house bookkeeping team. Additionally, outsourcing providers often offer flexible pricing structures tailored to your business’s needs, allowing you to pay for services only when required.

3. Enhanced Data Security

Data security is a top priority for businesses, especially when it comes to sensitive financial information. Outsourcing your bookkeeping’s services to reputable providers ensures that your data is protected with state-of-the-art security measures, including encryption, secure data centers, and access controls. Outsourcing providers adhere to strict security protocols to safeguard your financial data from unauthorized access, breaches, and cyber threats.

4. Scalability and Flexibility

Business needs fluctuate over time, and your bookkeeping requirements may vary depending on factors such as growth, seasonality, and market conditions. Outsourcing your bookkeeping offers scalability and flexibility to adapt to changing business needs seamlessly. Whether you need to scale up during peak periods or scale down during slower times, outsourcing providers can adjust their services to align with your evolving requirements.

5. Focus on Core Business Activities

Outsourcing your bookkeeping allows you to focus your time, resources, and energy on core business activities that drive growth and profitability. By delegating bookkeeping tasks to external professionals, you free up valuable internal resources to concentrate on strategic initiatives, business development, customer service, and innovation. This enables you to stay competitive in your industry and capitalize on new opportunities for success.

6. Improved Accuracy and Compliance

Bookkeeping errors and compliance issues can have serious consequences for your business, including financial losses, penalties, and reputational damage. Outsourcing your bookkeeping to experienced professionals reduces the risk of errors and ensures compliance with accounting standards, tax regulations, and reporting requirements. Outsourcing providers employ rigorous quality control measures and best practices to maintain accuracy and integrity in your financial records.

7. Access to Advanced Technology

Outsourcing your bookkeeping gives you access to advanced accounting software, tools, and technologies that may be cost-prohibitive to implement in-house. Outsourcing providers invest in state-of-the-art software platforms that automate routine bookkeeping tasks, streamline workflows, and enhance productivity. By leveraging cutting-edge technology, you can achieve greater efficiency, visibility, and control over your financial processes.

8. Timely Financial Reporting

Timely financial reporting is essential for monitoring business performance, making informed decisions, and meeting regulatory deadlines. Outsourcing your bookkeeping ensures that financial reports, statements, and reconciliations are prepared accurately and delivered on schedule. This enables you to analyze key metrics, track financial trends, and identify opportunities for improvement in a timely manner.

9. Business Insights and Analysis

Outsourcing your bookkeeping provides access to valuable business insights and analysis that can inform strategic decision-making and drive growth. Outsourcing providers analyze your financial data, identify trends, patterns, and anomalies, and provide actionable recommendations to optimize performance and mitigate risks. By leveraging their expertise, you can gain a deeper understanding of your business’s financial health and identify areas for improvement.

10. Peace of Mind

Perhaps the most underrated benefit of outsourcing your bookkeeping is the peace of mind that comes with knowing your financial affairs are in capable hands. Outsourcing providers assume responsibility for managing your bookkeeping tasks efficiently, accurately, and confidentially. It allowing you to focus on what matters most—running and growing your business. With outsourcing, you can trust that your financial records are in compliance, your data is secure, and your business is positioned for long-term success.

Wrapping Up!

Outsourcing your bookkeeping with MonkTaxSolutions offers numerous advantages beyond cost savings and efficiency gains. From access to expertise and enhanced data security to scalability, flexibility, and peace of mind. Outsourcing providers deliver value-added services that drive business performance and competitiveness.